Bergen County Real Estate Market Update: What’s Really Driving Home Prices in 2025?

Bergen County Home Prices Continue to Rise — But There’s More to the Story

Yes, Bergen County home prices are still climbing but as local Realtor Stacy Esser points out, looking at sold prices alone is like looking in the rearview mirror. To really understand what’s happening in today’s market, you have to look at leading indicators: price reductions, days on market, and buyer demand.

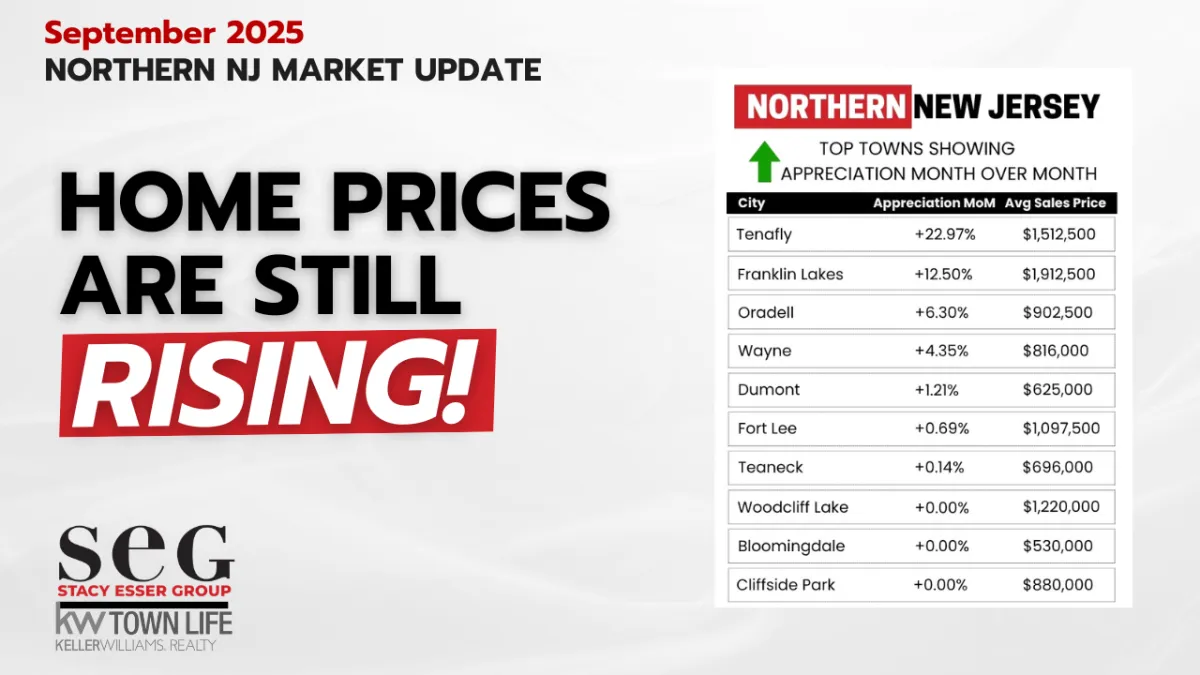

Through September 2025, average list and sold prices in Bergen County are both up about 12% year-to-date, with the median sold price increasing by roughly 10.4%. These numbers reflect a market that remains strong — but the data hides an important story beneath the surface.

What’s Really Driving the Bergen County Housing Market?

Behind those strong price increases, many sellers who don’t get their desired price are quietly taking their homes off the market rather than reducing. This “shadow inventory” makes it appear that sellers are firmly in control, when in reality, there’s a subtle tug-of-war happening between buyers and sellers.

Inventory remains exceptionally tight, which continues to place upward pressure on prices. Bergen County isn’t following the same trend as other national markets experiencing slowdowns — and the limited housing supply here is keeping things competitive.

Buyer Behavior: When the Price Is Right, Demand Follows

Homes that are priced correctly are still selling quickly and often above their listed prices. But when homes sit on the market longer, sellers are more likely to withdraw and re-list rather than negotiate.

This creates the illusion of a seamless market, but in truth, it’s a sign of buyer hesitation and affordability challenges. As days on market increase by 30–40 days in some cases, the market shows small but meaningful signs of cooling momentum — even as prices stay high.

Affordability Challenges and the Missing First-Time Homebuyer

The biggest shifts are happening among first-time buyers, who are struggling with affordability in Bergen County’s high-cost market. Many entry-level homes are being bought by developers, squeezing out younger buyers and contributing to the shortage of move-in-ready starter homes.

However, there’s a silver lining: mortgage rates are finally trending lower. As of mid-October 2025, average rates are around 6.25%, down from nearly 7% this time last year. This drop in rates could reignite buyer activity and make homeownership slightly more attainable particularly if the downward trend continues through the end of the year.

Looking Ahead: What Will Shift the Bergen County Real Estate Market?

Until inventory increases or affordability improves, Bergen County home prices are likely to remain stable or climb modestly. Lower interest rates could encourage more sellers to list and more buyers to enter the market, helping to balance supply and demand.

As Stacy explains, buyers don’t purchase a home price, they purchase a monthly payment. The moment those payments become more manageable, the local market could see a surge of new activity.

Key Takeaways for Bergen County Homeowners and Buyers

Prices remain strong: Up 10–12% year-over-year through September 2025.

Inventory is still tight: Keeping pressure on prices despite fewer active buyers.

Days on market are rising: Subtle signs of a market shift.

Affordability remains the biggest barrier for first-time homebuyers.

Falling mortgage rates could ease some of that pressure and spark renewed activity.